April 27, 2022

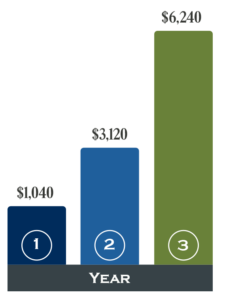

No song announced hip-hop’s entry into the mainstream louder than Biggie’s 1997 Billboard #1 single “Mo Money Mo Problems” (Ismail Muhammad, American Experience). While I appreciate the clever lyric, the reality is that when life happens, Mo’ Money does in fact mean No Problems. A major savings goal for most individuals or families should be establishing an emergency fund that’s large enough to handle major, unexpected expenses such as a new hot water heater or large medical bill. Without one, you could be forced to rack up unwanted debt when unplanned expenses rear their ugly head. Most financial planners recommend you save anywhere from three to six months’ worth of expenses just to be safe. Here’s an easy plan to help you get started. Start by estimating your fixed, monthly expenses, such as housing, food, transportation, and healthcare. Exclude any extra or non-fixed expenses such as dining out, shopping or travel. Once you know how much you need each month to cover the essentials, start saving—even if it’s in small increments. You can build up your emergency fund over time by consistently stashing away smaller amounts on a regular basis. We suggest setting up a GOALS account in DIGITAL BANKING+ to help you establish a savings routine. With it, you’ll be able to set up recurring transfers from your checking account to your GOALS account on a weekly or monthly basis. Just set it and forget it. As your income begins to grow you can start increasing the amount you put away each month. Let’s say you start building your emergency fund by automatically transferring $20 into your GOALS account each week. At the end of one year, you could have $1,040 stashed away in your emergency fund. That’s a great start! Double your weekly savings to $40 the following year and you will have $3,120 in savings at the end of year two! Bump up your weekly savings to $60 at the beginning of year three and you will have saved $6,240 over the course of three years. Stick with this simple savings plan and you’ll be ready when that rainy day comes – and it will. In honor of the 25th anniversary of Biggie’s iconic chart-topping hit, we’ve lovingly re-written the words to this beloved hip-hop classic. Enjoy!

MO MONEY NO PROBLEMS

Now what’s hot, why not?

Tell me what’s stopped, the water heater don’t flow?

Your wallets done popped, squeezed out the last drop

Your bills just hopped

Budgetary funds are now just a stage prop?

Get a new plan

We’ll set you up with a GOALS Account, man

Don’t stop saving coin, even if a dime

Money, money, money will build up over time

You soon will see the funds will grow, then you double up

You don’t play around, it’s a plan – lay it down

Savings didn’t seem big at first, bet you see them now

With the GOALS Account, funds are gonna be nice and sound.

No emergencies gonna hold your down

Now that’s savings is your game – routines your duty

Stay prudent, plan shrewd, flow like hootie

Saving green, planning, winning like Doug Flutie

Mo’ money, no problems you bet your booty

Chorus:

The GOALS Account from FUB

The mo’ money you put away

No problems you see

In honor of the 25th anniversary of Biggie’s iconic chart-topping hit, we’ve lovingly re-written the words to this beloved hip-hop classic. Enjoy!

MO MONEY NO PROBLEMS

Now what’s hot, why not?

Tell me what’s stopped, the water heater don’t flow?

Your wallets done popped, squeezed out the last drop

Your bills just hopped

Budgetary funds are now just a stage prop?

Get a new plan

We’ll set you up with a GOALS Account, man

Don’t stop saving coin, even if a dime

Money, money, money will build up over time

You soon will see the funds will grow, then you double up

You don’t play around, it’s a plan – lay it down

Savings didn’t seem big at first, bet you see them now

With the GOALS Account, funds are gonna be nice and sound.

No emergencies gonna hold your down

Now that’s savings is your game – routines your duty

Stay prudent, plan shrewd, flow like hootie

Saving green, planning, winning like Doug Flutie

Mo’ money, no problems you bet your booty

Chorus:

The GOALS Account from FUB

The mo’ money you put away

No problems you see