August 9, 2022

It seems that just about the time the stress from the end of the school year wears off, it’s time to start thinking and planning for the year ahead. Back-to-school is just around the corner and, with prices continuing to skyrocket thanks to decades-high inflation, it’s projected to cost considerably more than previous years to get your child back-to-school ready.

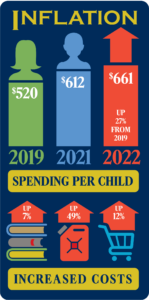

According to a recent back-to-school survey by Deloitte, parents plan to spend $661 per child, on average, for back-to-school shopping this year, up 8% from 2021 and 27% from 2019 with school supplies alone costing an average of 7% more. For most families, back-to-school shopping is one of the largest spends annually, behind the holidays and family vacations.

It seems that just about the time the stress from the end of the school year wears off, it’s time to start thinking and planning for the year ahead. Back-to-school is just around the corner and, with prices continuing to skyrocket thanks to decades-high inflation, it’s projected to cost considerably more than previous years to get your child back-to-school ready.

According to a recent back-to-school survey by Deloitte, parents plan to spend $661 per child, on average, for back-to-school shopping this year, up 8% from 2021 and 27% from 2019 with school supplies alone costing an average of 7% more. For most families, back-to-school shopping is one of the largest spends annually, behind the holidays and family vacations.

With the cost of gas prices and everyday essentials on the rise, it’s a good idea to start planning ahead for the upcoming school year. Here are a few budget-friendly tips to help you make the most of your back-to-school spending this season.

With the cost of gas prices and everyday essentials on the rise, it’s a good idea to start planning ahead for the upcoming school year. Here are a few budget-friendly tips to help you make the most of your back-to-school spending this season.

- Pull together a list of all your back-to-school needs including school supplies, clothing, backpacks, athletic equipment, etc. Try to be as thorough as possible! Once your list is complete, create a budget, and stick to it.

- Be sure to take your list with you as you shop so you are less likely to end up with a few extra items in your basket and blow your budget. It might also be worth leaving your precious kiddos at home while you shop.

- Before you head out, take a look at your current inventory. Do you have gently used colored pencils or fully functioning scissors that will get you through one more year? Can last year’s backpack or lunchbox, given a good cleaning, still do its job?

- Keep track of your spending by using the calculator on your phone and crossing purchased items off your list as you go.

- It’s a good idea to spend a little more for quality items such as a backpack and athletic shoes that will withstand the wear-and-tear of heavy textbooks and bad weather. Other necessities such as pens, pencils, notebook paper and pocket folders can be purchased in bulk at wholesale stores such as Costco or Sam’s Club. Find a group of moms willing to split bulk purchases to help save time and money.

- Don’t one-stop-shop. I know time is limited but it can pay (literally) to shop around for the best deals. Many of the basics can be found at dollar stores or online for much less than national retailers or your local grocery store.

- Opt-in to receiving email or text alerts from your favorite retailers to keep up with back-to-school sales. It’s also a good idea to follow them on social media for updates.

- Do you have a large group of family friends with kids around the same age? If so, do a clothing swap. Passing along jeans, jackets and other name-brand clothing can give your kids a new first-day outfit without breaking your budget.

- Gas prices are at an all-time high so joining a carpool with neighborhood friends can save everyone time and money.

- Finally, be sure to include school supplies in your monthly budget for extra expenses that come up throughout the school year.