Powerful tools to manage your personal finances

Money Manager is a tool available to all First United Bank customers within DIGITAL BANKING. By giving you the ability to import all your bank accounts, debts, savings, etc., it provides a real-time snapshot of your entire personal financial portfolio—all in one convenient location. Money Manager has applications to set financial goals, track spending, set and follow a budget, get an ovaerview of your net worth and other financial tools.

With Money Manager you can:

- Set financial goals

- Track spending in real-time on your Dashboard

- Set and follow a budget

- See an overview of your net worth

- Set activity alerts & reminders

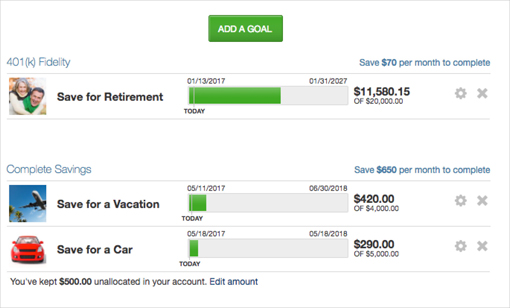

Set Financial Goals

Create your own savings or payoff objectives. These goals are customizable by type or savings amount, and you can see the progress.

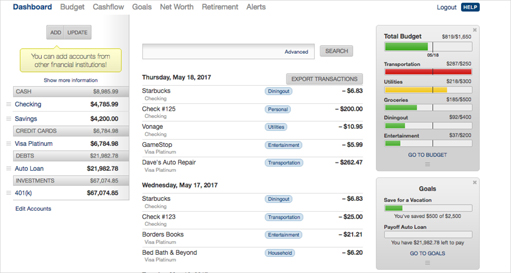

Track Spending on Your Dashboard

- Account aggregation – add & update your accounts (including external accounts), edit, delete and manage your accounts.

- Transaction feed – a real time feed of your transactions, tagged for categorization. You can change tags, split tags, perform advanced searches of transactions, and export transactions.

- Widgets – provide a visual snapshot of what’s important to you, customize these tools for your needs.

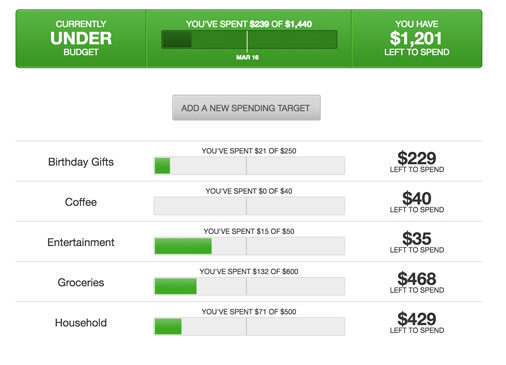

Set and Follow a Budget

Make sure you keep your finances on track with the ability to set and follow a budget that you can design specifically for your needs. You can set monthly limits and spending targets and track the progress for each month.

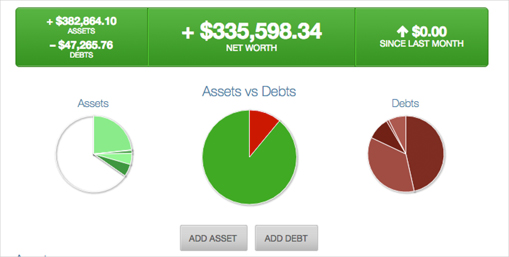

See an Overview of Your Net Worth

Monitor your current assets and debts. Money Manager automatically calculates net worth daily based on the accounts that have been added.

All accounts included in Money Manager are automatically used in the net worth calculation.

You have the option to exclude any of your accounts from the calculation.*

*Manually added assets and debts cannot be excluded from the calculation without deleting.

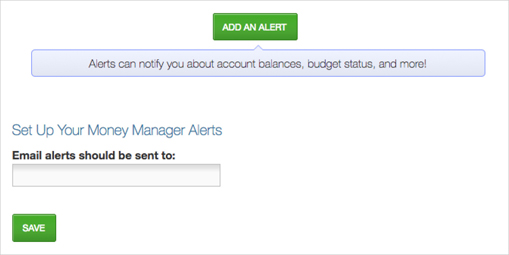

Set Activity Alerts & Reminders

Create your own customized alerts based on activity in Money Manager. There are six different alert types to choose from. These alerts will always show on the top of the Dashboard, but you can opt to receive text or eMail alerts.

- Account balance: Lets you know when the balance of a specified account falls below a certain amount.

- Spending target: Notifies you when you have spent a certain percentage of spending target(s).

- Goal progress: Notified when a certain threshold is met towards a specified goal.

- Bill reminder: Number of days before a bill is due.

- Large transaction: Any transaction comes through that is over a certain amount.

- Merchant name: A transaction is posted from a specified store.

Enroll in DIGITAL BANKING and start using Money Manager today!

Money Manager is a powerful tool that will help you get a grip on your personal finances—and that means fewer worries about money.