April 20, 2022

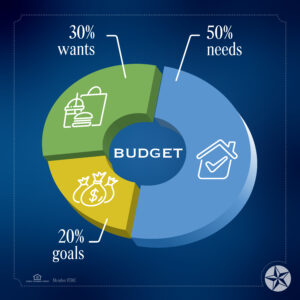

Budgeting is the key to feeling financially secure, but it’s not easy. If you’re feeling overwhelmed or in the dark about budgeting, no worries, you’re not alone. The 50/30/20 Rule of Thumb is an easy way to get your arms around something that is rather intimidating for most people. In a nutshell:- Dedicate 50% of your monthly income to needs or necessary expenses that you cannot avoid such as housing, groceries, utilities, transportation, childcare, and insurance. These are things you cannot live without.

- Dedicate 30% of your monthly income to wants – “extras” that aren’t essential to living and working. For many, distinguishing between needs and wants can be tricky and can certainly vary from one person to another. Often this category includes shopping, dining out, travel and entertainment.

- Use the remaining 20% of your monthly income to reach your financial goals. This is often in the form of savings and debt payments. Most financial advisors recommend you use this 20% of your monthly income for building a savings cushion and paying down existing debt. When it comes to saving money or paying off debt, every dollar saved is a dollar earned.

Like any rule of thumb, it’s a good idea to take the 50/30/20 rule with a grain of salt. Your personal financial situation might vary from month-to-month, or your savings goals might require a more aggressive savings routine, that’s okay. Figure out what works best for you and stick with it.

Not sure how to start budgeting? Use the interactive budget in DIGITAL BANKING+ to track your spending and identify areas where you can save money. You can even add custom tags and receipt photos to individual transactions so you can categorize your wants and needs each month.

Like any rule of thumb, it’s a good idea to take the 50/30/20 rule with a grain of salt. Your personal financial situation might vary from month-to-month, or your savings goals might require a more aggressive savings routine, that’s okay. Figure out what works best for you and stick with it.

Not sure how to start budgeting? Use the interactive budget in DIGITAL BANKING+ to track your spending and identify areas where you can save money. You can even add custom tags and receipt photos to individual transactions so you can categorize your wants and needs each month.