TREASURY MANAGEMENT SERVICES

Optimize liquidity while minimizing financial, operational and reputational risk. Our Treasury Management Services will provide you with a whole new level of perspective and control. Let us handle the financial aspects of your business so you can focus on the vision.

eDeposit Merchant Capture

Positive Pay

Merchant Card Services

Cash Management Services

Johnston Family - Spirit Mortgage

SPIRIT MORTGAGE

Easy Loan. Ideal Home. Let us help you find the perfect loan to meet your individual needs while personally guiding you through our streamlined mortgage loan process.

Get Prequalified in Minutes from Any Device

Find a Mortgage Loan Officer in Your Area

Explore Our Mortgage Loan Process

Berg Studios, Chuck & Melanie Berg

BUSINESS BANKING

With more than 100 years of business banking under our belts, we've learned a thing or two about what it takes to help West Texas businesses succeed.

Business Checking and Savings

Loans and Lines of Credit

Treasury Management Services

West Texas Business Spotlight

In Good Spirit

what’s happening at first united bank? see all.

Every Business has a Story

What makes us Different

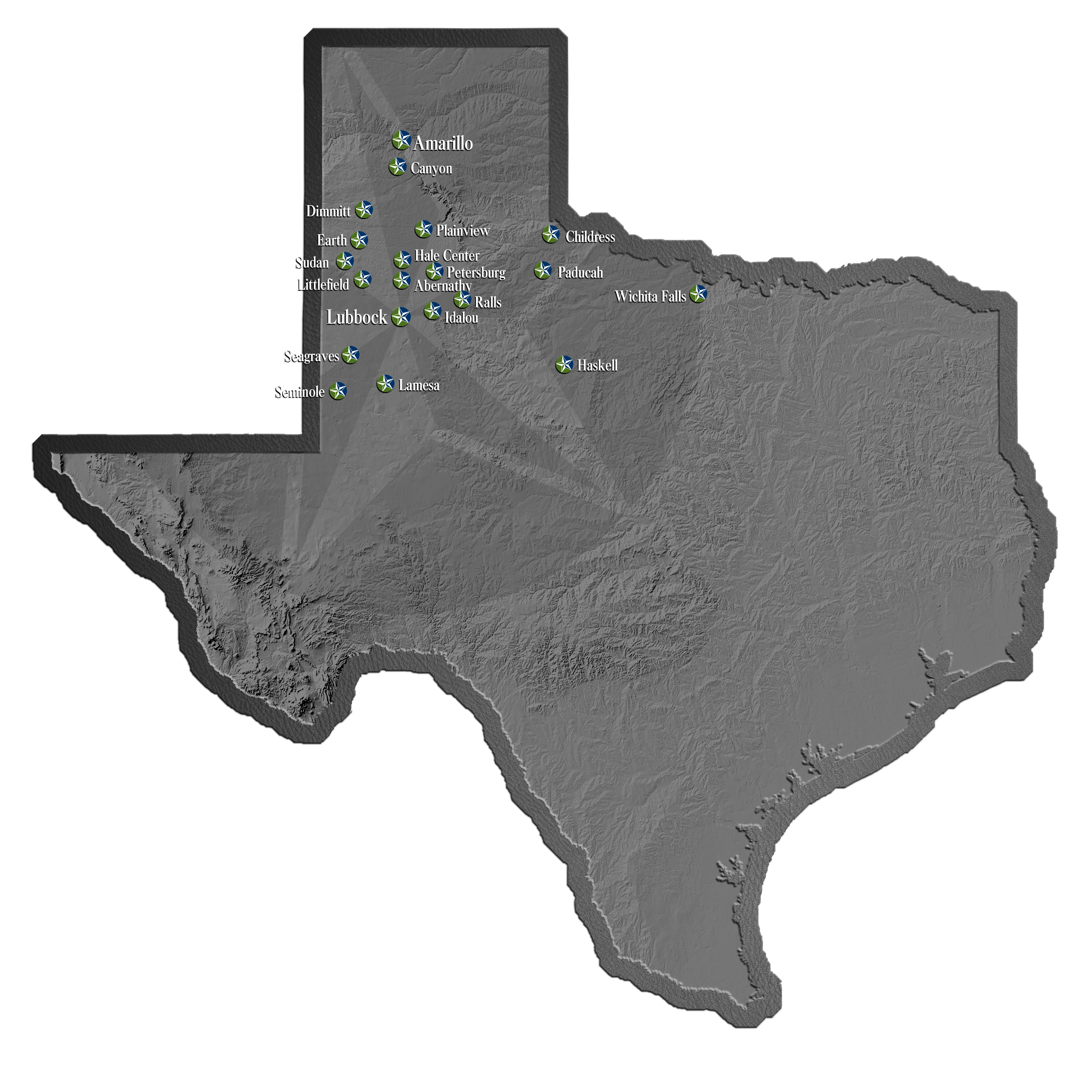

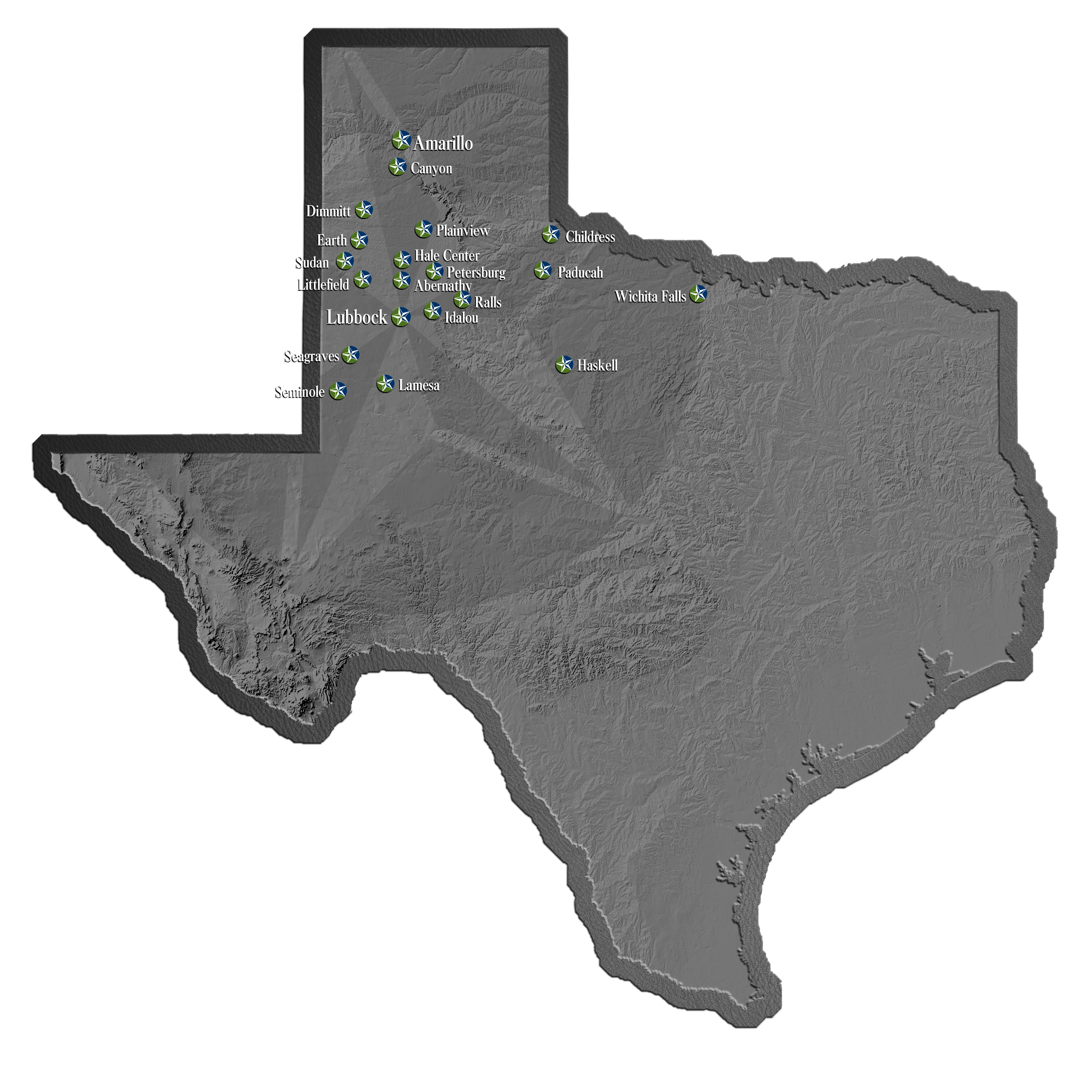

Roots run deep in West Texas for First United Bank. In fact, all our roots are right here. Since beginning in 1907 as The First State Bank of Dimmitt to First United Bank today, our business model has always been focused on West Texas communities, the people who live and work here and their distinct financial needs.

The Spirit of West Texas is the embodiment of a set of principles we live and work by: Generosity, Loyalty, Integrity, and Community. We will foster this Spirit by working hard, doing the right thing, helping our neighbors, nurturing our employees, doing more than we need to, valuing customers over currency and staying true to our roots.

The Spirit of West Texas PODCAST | Season Four

Hard to believe we’re rolling out our 4th season! It’s amazing how many wonderful people with remarkable stories there are in West Texas. Listen in!